Town of Ramapo may be insolvent – Is bankruptcy looming?

Friday, September 26th, 2014 @ 6:51PM

Over the last few months the Ramapo Republican Committee submitted FOIL requests to the Town of Ramapo requesting copies of the 2013 Financial Statements. The Town of Ramapo kept responding that the documents requested are not in their possession. On September 23, 2014, the town finally turned over a copy of their 2013 financial statements.

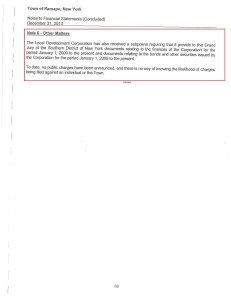

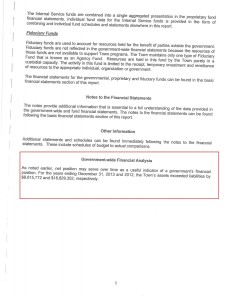

The notes to the financial statements indicated items that have already been previously reported. Namely, there was an FBI raid in May of 2013 and that there are SEC subpoena’s issued to the Town of Ramapo and the Ramapo Local Development Company (RLDC) in July of 2014.

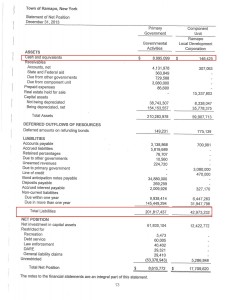

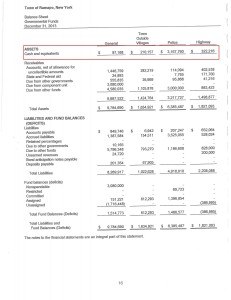

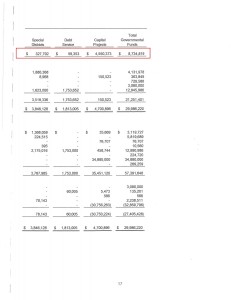

The 2013 Financial Statements indicate that the town had $8,995,099 cash on hand at 12/31/13 year end. When we dug deeper into this number things become more alarming. Included in that number is $3,167,760 in the police funds, $4,550,373 in the Capital Fund, $1,179,798 in various other funds, leaving only $97,168 in the General Fund. That implies the town only had $97,168 in cash on hand to run general town activities. Further, the Town of Ramapo had total liabilities exceeding $200,000,000 at that same point in time. This does not include unfunded liabilities and the $42,000,000 the RLDC owes. This is astonishing!

If you think the above numbers are bad, here comes even worse news.

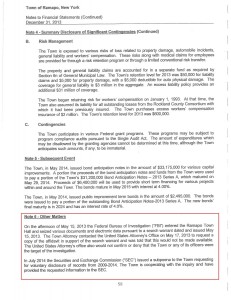

The net position of the town at 12/31/12 was $18,829,352. The net position of the town at 12/31/13 was $8,615,772. Net position is all assets less all liabilities (monies owed) by the Town of Ramapo.

Yes, the town net position decreased by more than 10 Million dollars in that 12 month period.

Included in the $8,615,772 net position of the town at 12/31/13 is a $3,080,000 loan due from the RLDC. This loan has been unpaid for many years and will probably never be repaid since the RLDC (i.e. Provident Bank Park and the Elm Street project) may never make money. When you exclude that $3,080,000 loan from the $8,615,772 net position, the adjust result at 12/31/13 is $5,535,772 of real net position. If the town continued to lose net value in 2014 at the same pace as 2013, it is possible that the town already became technically insolvent sometime in July, August, or September of this year.

Further note that the net position of the town went from $30.5 Million in 2011 to $18.8 Million in 2012 and $8.6 Million in 2013, so this pattern is very consistent and troubling to say the least.

We know that the town refinanced their Bond Anticipation Notes (Loan) in May of 2014. This gave them a little bit of extra cash flow, but that just buys them some time. According to some news reports, we also know that the town borrowed $3,000,000 from the police fund before the end of 2013. This loan according to some news reports appears to have not been paid back. You can never spend your way out of debt because as you keep digging yourself deeper and deeper into a hole, you start losing the ability to see out of that hole. Unfortunately, that is where we are at today.

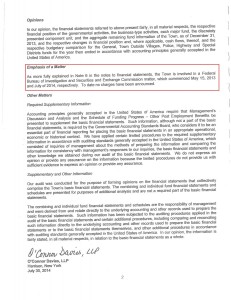

The facts laid out above is probably why the town kept denying our FOIL requests and only made the financial statement available now. It is also probably why the town released their financial statements past the deadline to New York State. Please also note that the auditors signed off on the financial statements on July 30, 2014. The Town of Ramapo should have made these financials available to the public in a reasonable time soon thereafter.

The town of Ramapo will probably continue the practice of filing its financial statements late with New York State and continue to operate under a veil of secrecy unless action is taken. We know the FBI and the SEC have ongoing investigations looking at the past practices of the town and who knows where that will end up, but the following actions need to be taken now:

- A fiscal monitor from the NYS Comptroller’s office needs to immediately step in.

- The Comptroller’s office, coupled with the independent auditors, need to do an interim financial statement immediately to determine the fiscal position of the town. We can’t afford to wait until sometime next year to find out where we stand as a town this year.

- The town residents need to Vote YES for the ward referendums on the September 30th special election ballot. The days of backroom deals, passing controversial resolutions while no one is watching, and ignoring the town residents concerns has to end. We need town board members who will do things that are in the best interest of the town and not only in their own personal political interest. We desperately need more Town Board members to participate in executive sessions and public meetings. This will ensure that town business is being conducted honestly for the people.

Do you know what would happen if the town goes bankrupt like Detroit? It would be devastating to home values. Imagine the impact on the school systems. Who would want to move to a town that is bankrupt? Services for many people who can’t afford it WOULD most likely be cut, vendors of the town would be paid late (if at all), and the jobs for the people who work for the town would be in jeopardy.

The numbers don’t lie and always tell the true story in the end.

Posted by ramapro1

Categories: Rockland